Bitcoin Drops 10% – What’s Behind the Sudden Crash?

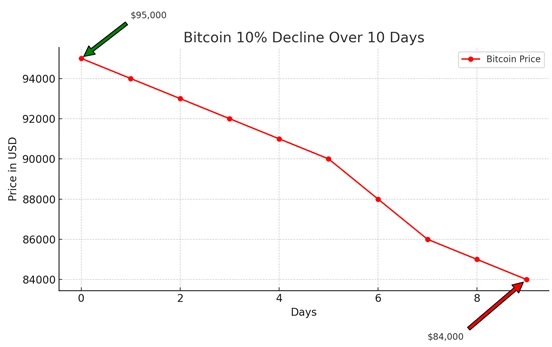

Bitcoin, the world’s largest cryptocurrency, has experienced a sharp decline, dropping nearly 10% from its recent highs. February ended with a staggering 17.5% monthly loss, marking Bitcoin’s worst monthly performance since June 2022. As of now, Bitcoin is trading around $84,252, leaving investors anxious about the road ahead. This downturn has also dragged the broader cryptocurrency market lower, wiping out billions in market capitalization.

So, what’s causing this selloff? Let’s analyze the key factors behind Bitcoin’s sudden crash and explore what the future holds for the crypto market.

1. Economic Uncertainty and Global Market Instability

One of the most significant reasons for Bitcoin’s decline is the growing economic uncertainty worldwide. Recently, former U.S. President Donald Trump announced a 25% tariff on imports from Canada and Mexico, sparking fears of a trade war. This unexpected move has sent shockwaves across global markets, increasing volatility and pushing investors towards safer assets.

Cryptocurrencies, being highly volatile, often react sharply to global economic developments. As concerns over a potential trade war grow, many investors have started selling off riskier assets—including Bitcoin—to hedge against uncertainty. The crypto market, which had been experiencing a bullish run, is now facing a significant pullback as investors become more cautious.

2. Bitcoin ETF Outflows at Record Highs

Institutional investors have played a major role in Bitcoin’s rise over the past year, particularly with the launch of Bitcoin Exchange-Traded Funds (ETFs). However, the trend has reversed in February, as Bitcoin ETFs saw a record $3.3 billion in outflows. This is the highest level of withdrawals since these investment products were introduced.

Why Are Institutional Investors Pulling Out?

- Profit-Taking: Many large investors who accumulated Bitcoin during its rise above $90,000 are now taking profits amid uncertain market conditions.

- Regulatory Uncertainty: Governments and financial regulators worldwide are considering stricter regulations on cryptocurrencies, leading institutional investors to reassess their holdings.

- Interest Rate Concerns: With no clear signal from the U.S. Federal Reserve on potential rate cuts, institutional investors are shifting focus towards more stable assets.

The massive outflow from Bitcoin ETFs has intensified selling pressure, contributing significantly to Bitcoin’s price drop.

3. Major Crypto Exchange Hack Raises Security Concerns

Security issues in the cryptocurrency sector have also played a crucial role in Bitcoin’s recent decline. A significant cyberattack on the Bybit exchange resulted in a $1.5 billion loss in Ether, raising concerns about the safety of digital assets on centralized platforms.

Whenever a major hack occurs, investor confidence in the broader crypto market tends to decline. Traders and investors become more cautious about keeping funds on exchanges, often opting to withdraw or sell their holdings. This fear-driven market sentiment has contributed to Bitcoin’s recent downward momentum.

4. Broader Crypto Market Downturn

Bitcoin is not the only cryptocurrency suffering losses. Other major digital assets like Ethereum (ETH), Solana (SOL), and XRP have also seen substantial declines, leading to an overall drop in the total crypto market capitalization. Since December 2024, the crypto market has lost over $1 trillion in value, erasing a significant portion of its previous gains.

Why Are Altcoins Crashing Alongside Bitcoin?

- Market Correlation: Most cryptocurrencies tend to follow Bitcoin’s trend, so when Bitcoin declines, the rest of the market usually follows.

- Investor Sentiment: Fear, uncertainty, and doubt (FUD) surrounding Bitcoin’s price drop have spilled over to altcoins, leading to panic selling.

- Regulatory Concerns: Governments worldwide are ramping up regulatory discussions around decentralized finance (DeFi) and non-compliant crypto projects, making investors wary of holding altcoins.

5. The Fear and Greed Index Drops

The Crypto Fear and Greed Index, which measures market sentiment, has seen a sharp decline, moving from Extreme Greed to Neutral within days. This shift indicates that the market’s previous bullish sentiment is fading, replaced by uncertainty and caution.

Historically, whenever the Fear and Greed Index moves towards fear, Bitcoin experiences further downside before stabilizing. If sentiment continues to weaken, we may see Bitcoin testing lower support levels.

6. Technical Analysis – Bitcoin at Key Support Levels

From a technical perspective, Bitcoin’s recent price action suggests that it has broken below key support levels around $88,000, indicating a potential downtrend. Analysts are now watching the next major support level at $80,000. If Bitcoin fails to hold this level, a further drop to $75,000 or lower could be on the horizon.

Key Technical Indicators:

- Relative Strength Index (RSI): The RSI has dropped below 50, signaling that Bitcoin may still have room for further downside.

- Moving Averages: Bitcoin has fallen below its 50-day and 200-day moving averages, a bearish signal that suggests more selling pressure.

- Volume Analysis: Selling volume has increased significantly, confirming the strength of the recent downtrend.

7. What’s Next for Bitcoin? – Predictions and Outlook

Despite the recent drop, Bitcoin’s long-term potential remains a topic of debate among analysts and investors. Standard Chartered Bank has predicted that Bitcoin could still reach $500,000 before Trump’s term ends, but current market conditions suggest a challenging road ahead.

Bullish Case – Why Bitcoin Could Rebound:

- Federal Reserve Rate Cuts: If the U.S. Federal Reserve decides to cut interest rates, investors may return to riskier assets like Bitcoin, driving prices higher.

- Bitcoin Halving Event: The upcoming Bitcoin halving, expected in mid-2025, could reduce supply and drive demand, historically leading to price increases.

- Increased Institutional Adoption: If institutional investors return with renewed confidence, Bitcoin could see another bullish rally.

Bearish Case – Why Bitcoin Could Decline Further:

- Continued Market Uncertainty: If global economic conditions worsen, investors may continue selling off Bitcoin to reduce risk exposure.

- Regulatory Crackdowns: Stricter regulations or bans on crypto activities in major economies could negatively impact Bitcoin’s price.

- Further Security Breaches: Additional exchange hacks or security vulnerabilities could cause further panic selling.

Conclusion: Should You Buy, Hold, or Sell Bitcoin?

The recent 10% drop in Bitcoin’s price has left many investors wondering whether to buy the dip or wait for further declines. The answer largely depends on individual risk tolerance and investment strategy.

If you’re a long-term investor: Bitcoin’s fundamentals remain strong despite short-term volatility. Historically, Bitcoin has recovered from corrections and reached new highs. If you believe in Bitcoin’s long-term value, this dip could be a buying opportunity.

If you’re a short-term trader: The current market is highly volatile, and further declines are possible. Traders should closely watch technical indicators and market sentiment before making decisions.

If you’re unsure: It may be wise to wait until Bitcoin finds strong support and market sentiment improves before entering a position.

Final Thoughts

Bitcoin’s 10% decline is a stark reminder of the volatility in the cryptocurrency market. While short-term factors like economic uncertainty, ETF outflows, and exchange hacks have driven the recent selloff, the long-term future of Bitcoin remains promising. However, investors should remain cautious, keep an eye on key support levels, and stay updated with global economic trends.

With both bullish and bearish scenarios in play, the next few weeks will be crucial in determining Bitcoin’s future trajectory. Will Bitcoin rebound, or is a deeper correction ahead? Only time will tell.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry risks, and you should conduct your own research or consult with a financial advisor before making any investment decisions. The opinions expressed in this article do not constitute investment recommendations. Always exercise caution and stay informed before investing in any digital asset.

🚀 What do you think about Bitcoin’s current dip? Is it a temporary correction or the start of a bigger crash? Share your thoughts in the comments! 🚀

Also Read

Where Is Linux Most Used in 2025? Exploring Its Dominance Across Industries