Bitcoin's Big Moment: What’s Driving the $118,856 All-Time High?

On July 10, 2025, Bitcoin soared to a new all-time high of $118,856, a milestone that has captured the attention of investors, enthusiasts, and skeptics alike. This peak, surpassing the previous high of $111,560, underscores Bitcoin’s growing prominence in the global financial landscape. But what’s behind this remarkable surge? From institutional adoption to supply constraints, several factors are converging to propel Bitcoin to new heights. At the same time, the risks of investing at such levels—volatility, regulatory uncertainty, and environmental concerns—cannot be ignored.

In this comprehensive analysis, we’ll explore the drivers of Bitcoin’s Big Moment, the potential pitfalls, and what it means for investors.

The Journey to $118,856

Bitcoin’s price history is a tale of dramatic ups and downs. Since its creation in 2009, it has weathered multiple bull and bear cycles, each setting new records. The previous all-time high of $111,560 was achieved earlier in 2025, but Bitcoin’s ascent to $118,856 marks a significant leap forward.

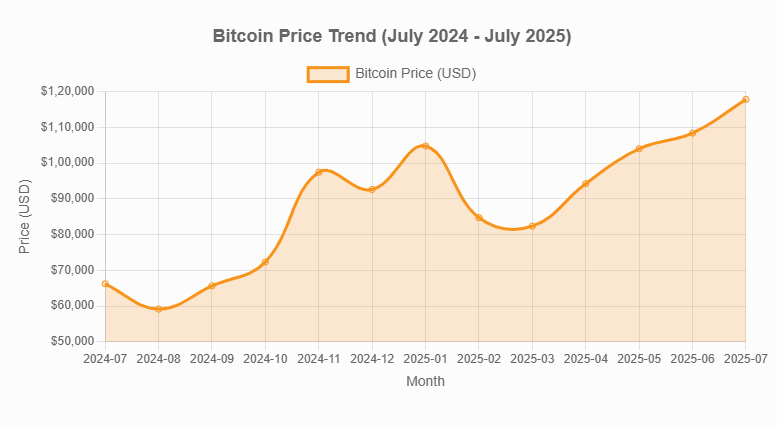

Recent price data illustrates this upward trajectory. On June 14, 2025, Bitcoin was trading at approximately $106,045.56. By July 11, it had climbed to $115,879.65, and on July 12, it briefly touched $118,856, according to sources like CoinMarketCap. The chart above shows Bitcoin’s price trend over the past year, highlighting its steady climb from $66,219.05 in July 2024 to $117,828.11 in July 2025.

This surge is not a random spike but the result of several fundamental factors that have aligned to drive Bitcoin’s value higher.

Driving Forces Behind the Surge

Several interconnected factors are fueling Bitcoin’s latest all-time high. Here’s a detailed look at the key drivers:

1. Institutional Adoption

Institutional investors are playing a pivotal role in Bitcoin’s price surge. Bitcoin-focused Exchange-Traded Funds (ETFs) have seen massive inflows, with $4.6 billion invested in June 2025 alone, according to The Motley Fool. These ETFs allow traditional investors, such as hedge funds and pension funds, to gain exposure to Bitcoin without directly holding the asset, making it more accessible to mainstream markets.

Corporate treasuries are also jumping on board. For example, Tesla holds 11,509 Bitcoins, valued at roughly $1.4 billion at current prices. Other companies are adopting Bitcoin treasury strategies, buying and storing coins with leverage to diversify their balance sheets. This institutional demand signals a growing acceptance of Bitcoin as a legitimate asset class.

2. Supply Constraints

Bitcoin’s fixed supply is a cornerstone of its value proposition. With a maximum cap of 21 million coins, approximately 94% have already been mined as of July 2025. Additionally, an estimated 20% of all Bitcoins are lost forever due to forgotten passwords or misplaced wallets, further reducing the circulating supply.

The Bitcoin halving events, which occur roughly every four years, exacerbate this scarcity. The most recent halving in April 2024 reduced the daily mining output from 900 to 450 Bitcoins. The next halving, expected in late Q1 or early Q2 2028, will halve it again, making new Bitcoins even scarcer. This supply constraint, coupled with rising demand, creates a powerful upward pressure on prices.

3. Legislative Developments

The cryptocurrency space is gaining increased attention from policymakers, which may be contributing to Bitcoin’s bullish momentum. The U.S. House of Representatives has scheduled “Crypto Week” starting July 14, 2025, to focus on digital assets, as noted by Unchained. This initiative could lead to clearer regulations or more favorable policies, boosting investor confidence.

In March 2025, a U.S. executive order mandated the creation of a Strategic Bitcoin Reserve (SBR) for coins forfeited in legal proceedings. While this reserve has not yet been implemented and faces legal challenges, it reflects growing governmental recognition of Bitcoin’s significance, which could further legitimize the asset in the eyes of investors.

4. Market Dynamics

The current bull run is distinct from previous cycles, characterized by a shift from retail to institutional investors. Unlike the 2021 bull market, which was driven by retail enthusiasm and speculative fervor, today’s market is dominated by institutions with longer holding periods. This shift has brought stability, as institutional investors are less likely to sell during price dips.

ETF inflows have remained strong even during market corrections, suggesting that patient capital is replacing speculative traders. Trading volume also surged by 95% to $122 billion over 24 hours when Bitcoin hit $118,856, indicating robust market activity and interest.

Risks and Concerns

While Bitcoin’s all-time high is exciting, it comes with significant risks that investors must consider. Here are the key concerns:

1. Volatility

Bitcoin’s price is notoriously volatile, with daily swings of 10% or more not uncommon. For instance, on July 11, 2025, Bitcoin’s price fluctuated between $116,593 and $118,667 within a single day. This volatility makes it challenging to predict short-term movements and can lead to substantial losses, especially for those using leverage or investing with debt.

2. Regulatory Risks

The regulatory landscape for cryptocurrencies remains uncertain. Governments worldwide are still determining how to classify and regulate digital assets. Stricter regulations could impact Bitcoin’s price and adoption. For example, increased scrutiny on Bitcoin mining due to its environmental impact could lead to restrictions or higher costs for miners, as noted by Hedge with Crypto.

3. Security Concerns

Holding Bitcoin requires secure storage solutions. Exchanges are vulnerable to hacking, and self-custody wallets demand careful management of private keys. Losing access to these keys results in permanent loss of funds, as there is no central authority to recover them. Geopolitical and climate risks, such as natural disasters, can also threaten self-custodied Bitcoin, as highlighted by CNBC.

4. Environmental Impact

Bitcoin mining consumes significant energy, primarily from fossil fuels, raising environmental concerns. This has led to increased scrutiny and potential regulatory actions that could affect Bitcoin’s price. However, some mining operations are transitioning to renewable energy, which may mitigate this risk over time.

5. Market Manipulation

The cryptocurrency market’s relative youth and lack of regulation make it susceptible to manipulation. Pump-and-dump schemes, wash trading, and other fraudulent activities can distort prices, as warned by Connecticut Department of Banking. Investors should be cautious of promises of guaranteed returns, which are often red flags for scams.

6. Lack of Intrinsic Value Critics, such as those from the Brookings Institution, argue that Bitcoin lacks intrinsic value and relies on the “greater fool theory,” where its price depends on finding someone willing to pay more. This speculative nature increases the risk of a price bubble.

| Risk Factor | Description | Potential Impact |

|---|---|---|

| Volatility | Price swings of 10%+ in a day | Significant losses for leveraged investors |

| Regulatory Uncertainty | Evolving global regulations | Price corrections or adoption hurdles |

| Security Concerns | Hacking or loss of private keys | Permanent loss of funds |

| Environmental Impact | High energy consumption | Regulatory scrutiny or public backlash |

| Market Manipulation | Fraudulent schemes like pump-and-dump | Distorted prices and investor losses |

What Does This Mean for Investors?

Deciding whether to invest in Bitcoin at its all-time high depends on individual risk tolerance and investment goals. Here are some considerations:

Is Now a Good Time to Invest?

Bitcoin’s current price of $117,831 (as of July 12, 2025) reflects its strong fundamentals and growing adoption. Historical data suggests that Bitcoin often recovers from dips and sets new highs over time. However, buying at an all-time high carries risks, as prices can correct sharply if market sentiment shifts.

For long-term investors who view Bitcoin as a store of value or hedge against inflation, now could still be a viable entry point. However, a cautious approach is essential. Strategies like dollar-cost averaging (DCA), where you invest a fixed amount regularly, can help mitigate the impact of volatility by averaging out the purchase price over time.

Balancing Risk and Reward

Diversification is key to managing risk. While Bitcoin offers high return potential, it’s a high-risk asset. Allocating only a portion of your portfolio to Bitcoin—typically 1-5% for conservative investors—can help balance potential losses. Staying informed about regulatory developments and market trends is also crucial, as the cryptocurrency space is highly dynamic.

Investors should also be mindful of psychological risks, such as fear of missing out (FOMO) or panic selling during downturns. A disciplined approach, focusing on long-term goals rather than short-term price movements, can help navigate these challenges.

Conclusion

Bitcoin’s all-time high of $118,856 is a testament to its growing acceptance and the fundamental strengths that set it apart from traditional assets. Institutional adoption, supply constraints, legislative developments, and evolving market dynamics have converged to drive this milestone. However, the risks—volatility, regulatory uncertainty, security concerns, environmental impact, and market manipulation—cannot be overlooked.

For investors, a balanced approach is essential. Strategies like dollar-cost averaging, risk management, and diversification can help navigate the volatile cryptocurrency market. As Bitcoin continues to mature, its role in the global financial system is likely to expand, but the journey will be marked by both opportunities and challenges.

Whether you’re a seasoned investor or a curious observer, Bitcoin’s big moment highlights the transformative power of decentralized finance. With upcoming halving events, continued institutional interest, and potential regulatory clarity, the stage is set for further growth. But as with any investment, thorough research and prudent risk management are key to success.

Disclaimer

The information provided in this blog post is for informational and educational purposes only and should not be considered financial advice. Investing in Bitcoin or other cryptocurrencies involves significant risks, including high volatility, potential loss of principal, regulatory uncertainties, and security vulnerabilities. Past performance is not indicative of future results. Prices and market conditions mentioned are based on data available as of July 12, 2025, and may change rapidly. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

Also Read

Exploring eBPF in 2025: Supercharging Linux Observability and Security